Due to the fact that insurance providers utilize different variables to rate rates, the cheapest insurance company before an infraction most likely will not be the least expensive after. sr22. Our analysis found that while Geico had the most inexpensive typical yearly price for a great vehicle driver with minimal protection, after a drunk driving the price boosted by more than 150%, pushing the company out of the leading 5 most inexpensive firms for an SR-22 in California.

You have actually been informed that to restore it, you require to get auto insurance coverage and file an SR-22 type. Just how can you reinstate your vehicle driver's license without insurance when you have to have vehicle insurance to reinstate your permit? Well, take a breath of relief since vehicle insurance policy business aren't brand-new to SR22 demands as well as lots of will make exceptions to help you obtain what you need.

While automobile insurance coverage business usually need insurance holders to have a valid motorist's license in order to get a vehicle insurance plan, they do make exemptions because there are circumstances when obtaining a permit is dependent upon having insurance. Vehicle insurance provider that will certainly submit an SR-22 are aware that numerous times the state must get this certification of economic responsibility prior to a certificate will certainly be reinstated - bureau of motor vehicles.

Be honest, It never ever pays to deceive an insurance company regarding your driving document. Allow them know quickly you will certainly need an SR22 as they will have to file it along with your insurance policy protection with the state.

What Does Sr-22 Insurance: What It Is And How To Get It – Forbes Advisor Do?

Broaden your insurance provider search, Take into consideration insurance coverage companies that may not be as well-known as significant across the country insurance providers. Second-tier insurance firms tend to collaborate with drivers that have much less than outstanding driving documents and also most of them are owned by large nationwide insurer. sr22 coverage. Along with significant service providers, you should likewise take into consideration smaller cars and truck insurance policy firms that specialize in risky, or "non-standard," protection.

Once you have acquired the plan your insurance firm ought to file the SR22 with the state after putting your plan in place. Obtain your license back, Once you have evidence of insurance coverage and also your insurance company has submitted the SR22 it is time to head to the DMV (insurance coverage).

You should validate with your car insurer after the reinstatement that they have obtained in the information revealing your certificate is currently legitimate, otherwise your plan and also SR-22 might terminate out, which would certainly lead to your permit being put on hold once more. Pay your car insurance plan premiumsno issue what, If you wish to keep your license, make sure you pay your premium (underinsured).

The DMV will certainly be alerted you are no more guaranteed, and also they will certainly resuspend your certificate. If this happens, discovering another insurance firm to take a gamble on you will certainly get much harder. Shop your SR22 insurance commonly, You should shop your car insurance policy coverage regularly, specifically as milestones approach.

The Facts About Sr-22 Auto Insurance Revealed

Your rates need to obtain a little better each year. Frequently Asked Inquiries, The fast response is no, an SR22 is not a license to drive, nor will it make you entirely legal out on the streets simply by itself (insurance companies). An SR22 is merely a record that confirms you are carrying the correct automobile insurance protection.

If you are captured driving to an area not approved, the hardship certificate will certainly be revoked, and also your normal suspension might be extended. It differs depending upon the state you reside in, some states require an SR-22 when a certificate is restored while others will not. In many states, you are required to have actually an SR22 connected to your insurance coverage for a collection quantity of time depending on the offense.

The takeaway here is that probably you will certainly have to keep an SR22 in location long after your license has actually been reinstated. You will require to get in touch with your state's Department of Electric motor Vehicles regarding the SR22 demand for your specific offense - insurance group. While it will vary by state, in many cases the solution is of course.

Possibilities are your state will be looking to see if you were covered for particular restrictions of physical injury responsibility and residential or commercial property damage responsibility at the time of your DWI."Full coverage" refers to physical damages coverage you were lugging at the time of your arrest. While obligation protection is called for in almost all states, collision and comprehensive are almost never called for insurance coverages.

The 2-Minute Rule for Section 9: Sr-22 (Proof Of Financial Responsibility)

Nevertheless, if the cars and truck is not covered by crash and thorough protection, simply ensure you can manage to replace the cars and truck if an accident takes place. Various other methods to conserve cash on your costs so you take advantage of low-cost SR22 insurance coverage is by selecting a greater insurance deductible (insurance). Your month-to-month price is lower when you choose a high insurance deductible, yet you'll have to pay more out-of-pocket if you remain in a crash.

Which states need SR-22s? Each state has its own SR-22 coverage demands for motorists, and also all go through transform. Obtain in touch with your insurance carrier to discover out your state's existing needs and also see to it you have appropriate protection. For how long do you need an SR-22? The majority of states require vehicle drivers to have an SR-22to prove they have insurancefor concerning three years.

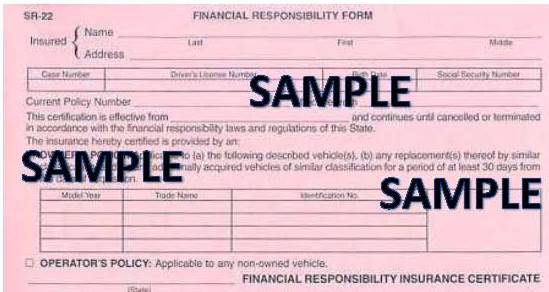

An SR-22 is a kind of kind filed with the Division of Electric Motor Autos (DMV) to reveal that a chauffeur has an auto insurance plan effective (credit score). SR-22s are generally needed after a person's driver's certificate is suspended due to a major violation like a DUI or reckless driving conviction.

If you have recently been informed you require an SR-22 declaring, Bankrate can help you recognize what you need to do, specifically what an SR-22 kind means and also just how much you can expect your premium to boost. Having this expertise might aid you browse your situation and also be better gotten ready for the ins and outs of your SR-22 demand.

Things about Texas Sr22 Insurance - Same Day Coverage

If your driving benefits were withdrawed after a major violation, you would certainly need to confirm that you have insurance coverage to reinstate your permit. An SR-22 demand means that your insurance provider will require to file the SR-22 type with the DMV as evidence of your coverage (no-fault insurance). Each policy revival, the DMV will be updated that you still have coverage.

Vehicle insurance coverage is much more expensive for risky motorists in California as a result of the likelihood of crashes. Automobile insurer evaluate just how high-risk insuring you would be before they approve you for insurance coverage. They're looking for hints that you might cause mishaps that would need an insurance claim payment. Generally, the higher threat you're thought about, the extra you'll spend for vehicle insurance policy.

The insurance policy firm can issue the SR-22 kind to the DMV. Not all insurance coverage firms sell non-owner cars and truck insurance coverage, however, and also not all business file SR-22 types, so you'll need to shop around to find a business that will certainly underwrite you.

This allows the DMV understand that you are maintaining at the very least the state's minimum necessary levels of insurance coverage. What takes place if I cancel my SR-22 insurance policy? When your insurer issues you an SR-22, they're letting the DMV know that you are presently guaranteed with at the very least the state's minimum requirements.

4 Easy Facts About Get Your License Back With Sr-22 Insurance Shown

These are example prices and must just be made use of for relative objectives. insurance group. Incidents: Rates were determined by evaluating our base profile with the adhering to events used: clean document (base), at-fault accident, single speeding ticket, single drunk driving sentence and also gap in protection.

Declaring charges are quite low, motorists that need SR-22 insurance coverage will locate that their prices are more costly due to the DUI or other offense that led to the SR-22 demand in the initial area. How much does SR-22 cost in California? SR-22 insurance in The golden state will certainly cost more than what you formerly spent for vehicle insurance policy, yet this is mostly as a result of the violation that triggered you to need an SR-22 declaring.

Whether or not your present insurance company will certainly submit an SR-22 for you, one of the most basic methods to make certain you're getting one of the most inexpensive SR-22 protection is to compare quotes from multiple companies. Lots of major insurance providers in California, consisting of Progressive as well as Geico, will file SR-22 types. Because every insurer evaluates your motoring background according to its own criteria, we suggest comparing a minimum of three quotes to ensure you're getting the best prices.

A chauffeur with no-DUI history paying $100 per month for car insurance might receive a 20% good chauffeur price cut and only pay $80 per month. After obtaining a DUI, the vehicle driver will certainly be back to paying at least $100 per month, which is 25% more than the prior price cut rate.

How Jacksonville Sr-22 Insurance - Suspended Driver's License can Save You Time, Stress, and Money.

Note that the SR-22 insurance coverage plan needs to provide all cars you possess or on a regular basis drive. For how long do you need to have an SR-22? The length of time you'll require to keep SR-22 depends upon your sentence, which need to mention the length of time you're anticipated to keep the SR-22 declaring. sr22 insurance.

Maintaining constant insurance coverage is essential. Any type of lapses in your SR-22 car insurance policy will certainly create your driving opportunities to be suspended once more, as your insurance firm would certainly file an SR-26 kind with the DMV alerting them of the lapse. If you vacate California during your required declaring period, you'll need to find an insurance provider that does business in both states and also is prepared to file the type for you in the state.

Throughout the one decade following a DRUNK DRIVING, you will not be eligible for a great driver discount rate in The golden state. Hereafter duration has actually expired, the drunk driving will be eliminated from your driving document and you will certainly be eligible for the price cut again. division of motor vehicles. You might have the ability to obtain the conviction removed from your record earlier, however as long as you stick with the very same insurer, the firm will certainly find out about the drunk driving as well as remain to utilize it when establishing your SR-22 insurance policy prices.

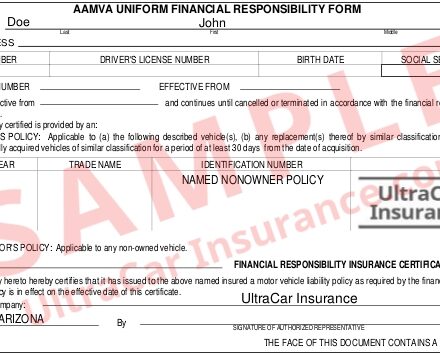

However it gives coverage if you occasionally drive other individuals's automobiles with their consent. For those that do not own a vehicle, non-owner SR-22 insurance policy is a plan that offers the state-required responsibility insurance coverage yet is linked to you as the vehicle driver, despite which automobile you use. One of the advantages of non-owner SR-22 insurance coverage is that quotes are generally less expensive than for an owner's plan, because you'll just get obligation insurance coverage as well as the insurance company presumes you drive much less regularly.

The smart Trick of Washington Sr-22 Insurance (Quotes And Rankings) That Nobody is Discussing

Methodology To determine the average cost of SR-22 insurance in California, we gathered statewide ordinary rates from 8 insurance companies: Mercury, Allstate, CSAA (AAA Neither, Cal), Farmers, Geico, Interinsurance Exchange (AAA So, Cal), State Farm and also United Automobile Insurance Co. (UAIC) (car insurance). All quotes are for minimum coverage plans for a 30-year-old male who is legitimately needed to have his insurance company submit an SR-22 on his part.

These prices were publicly sourced from insurer filings as well as should be used for relative functions just your very own quotes might be different - motor vehicle safety.

If you do not possess an automobile however are needed to submit an SR22, you will need to speak to an insurance agent to acquire a non-owner car insurance coverage. Inform the representative regarding your circumstance. The representative will certainly guide you through the process as well as SR22 requirements. They can even electronically total and also submit the required SR22 forms for you, where permitted.

Make certain that you are aware of your state's SR22 legislations, in addition to any added requirements mandated by the courts and/or DMV in your area. While it might sound unusual to bring a cars and truck insurance coverage when you don't possess a vehicle, a non-owner automobile insurance coverage covers cars you could drive briefly, such as when obtaining an auto from a buddy - sr22 insurance.